301. Insights playbook 🛍️

How (and why) to make Insights a dedicated part of your marketing team

Hi there 👋

Happy new year! Thank you to everyone who replied to my year-end survey about how to make this newsletter as valuable as can be. There’s still time to share feedback. In the meantime, I wanted to let you see the responses so far.

Most valuable topics (in order):

High-level marketing strategy

Channel strategy and playbooks

Hiring and team-building

Content you’d like to see more of:

■■■■■■■■ Playbooks

■■■■■■ New tools and resources

■■■ Brand teardowns

■■ Transparent stories from inside Oyster

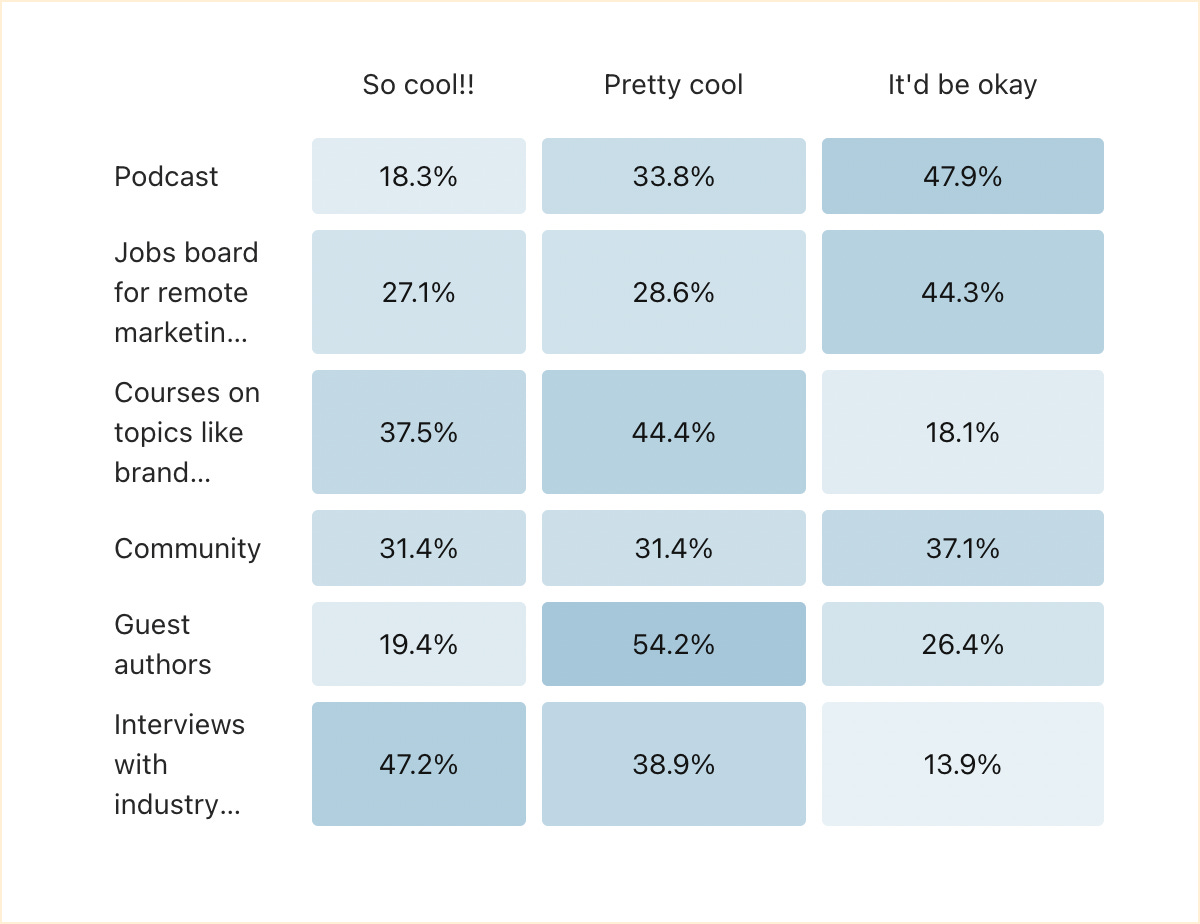

Your excitement about new and different content: The top choice is interviews with industry leaders …

Once I get my act together, I’ll be experimenting with interviews every so often as well as expanding the number of marketing playbooks I share here … starting this week.

Wishing you a great 2022. Thanks for being here!

Kevan

(ᵔᴥᵔ)

Thank you for being part of this newsletter. Each week, I share playbooks, case studies, stories, and links from inside the startup marketing world and my time at Oyster, Buffer, and more.

Say hi anytime at hello@kevanlee.com. I’d love to hear from you.

So you want to build an insights team. Here’s my competitive intelligence playbook

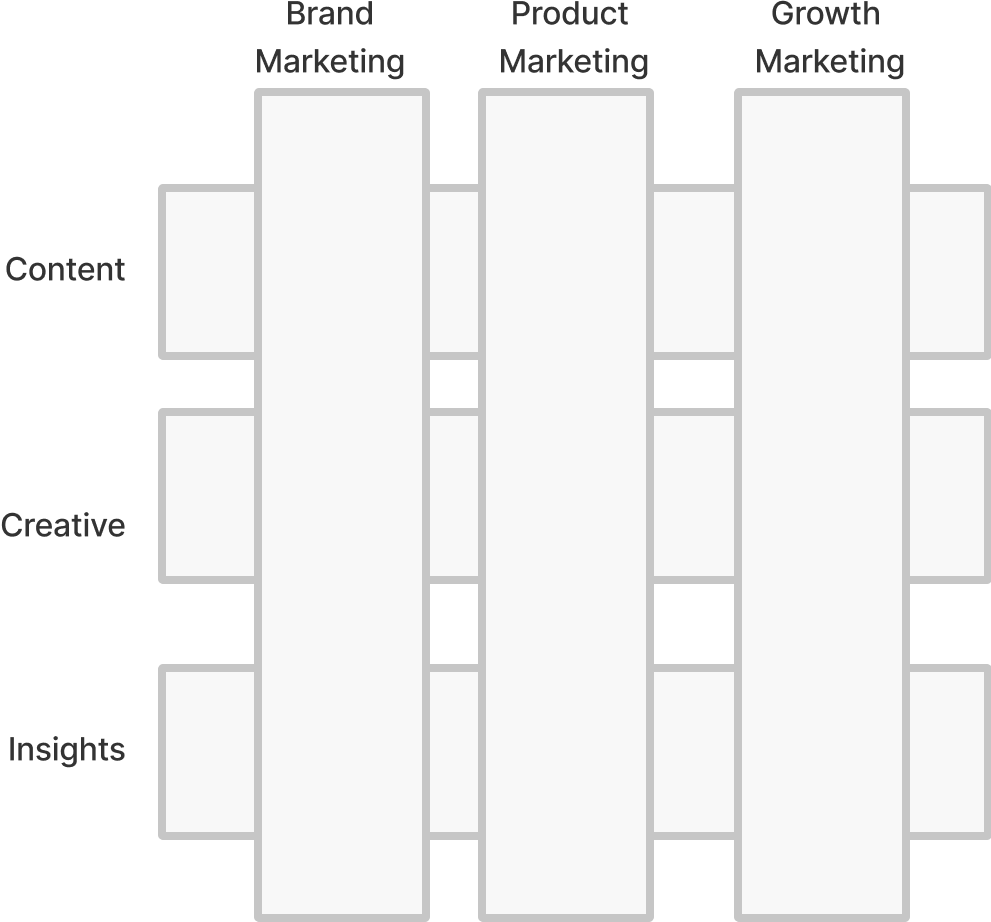

Marketing can be divided into three pillars, what I call “Three-body marketing.”

Brand marketing, which answers the question of who we are

Product marketing, which answers the question of what we sell

Growth marketing, which answers the question of how we sell it

This makes for a neat and tidy org structure where these three pillars can have robust teams themselves.

When you reach a certain scale — or if you have grand ambitions to scale super fast — you’ll also need the supporting layers that enable the pillars to move quickly. These horizontal layers can have both a proactive, strategic lens and also function as a service layer that works across all teams. At Oyster, this is the role that content and creative play for us.

And now we’re introducing Insights as a third layer.

What we end up with is a matrixed organization with three pillars and three layers. It looks like a giant hashtag.

Insights as a marketing function is new to me. This will be my first time hiring for the role. Typically, I see Insights living within product marketing as one of the core pillars of a product marketing manager’s role. (There are four pillars for a PMM: go-to-market, positioning, messaging, and research.) But in our current state at Oyster, Insights plays such a critical role and product marketing has so much else to do that it makes sense to break out Insights into its own function.

If you’re interested in what a Director of Insights would do, feel free to check out the job description we’ve put together here. And if you might like to come work with me, please do apply! I’d love to explore it with you.

I’m sure that the incoming Director of Insights — and there are lots of great ones out there — will have their own plans and playbooks to take our Insights area to new heights. For what it’s worth, I thought I’d share a version of an Insights playbook that worked at Buffer and at Oyster so you can get a taste for what Insights might look like in your marketing team.

Insights covers two main workstreams: competitive intelligence and market research.

Workstream #1: Competitive intelligence

Program: Competitor research

We use a competitive intelligence tool to collect and organize competitor updates, website changes, news alerts, press releases, and social media. Both Crayon and Klue are excellent. Klue focuses its intel on creating battlecards for your sales team. Crayon uses Artificial Intelligence to highlight major updates as well as a dedicated (human) account manager to assess and refine our intelligence programs.

In both instances, the intel is presented in a stream of real-time content and sent out in a weekly email with highlights and commentary from an account manager.

Program: Secret Shopping

Frequency: Quarterly

Location: Upwork + Google Docs

We work with freelancers on the Upwork platform to conduct secret shopper projects on a quarterly basis. Each project follows a consistent format, using a template with questions sourced from product, sales, and marketing.

Secret shoppers are asked to request demos with competitor companies, to record screenshots / video / audio, and to collect sales collateral and legal documents whenever possible.

Program: Crowdsourced Research

Frequency: Always-on

Location: #market-intelligence channel in Slack

In this Slack channel, team members are able to add any market intelligence they notice from articles, social media, prospect calls, customer research, etc. In many cases, there is overlap with what Crayon or Klue captures, and any net-new intelligence can be added back to Crayon / Klue.

Program: Platform Access

Frequency: Always-on

Location: Notion

If possible, we try to have a live account on other competitor platforms so that we can better assess product features and UX, monitor new functionality, and receive lifecycle communication (email, in-app, etc).

Workstream #2 - Market research

Program: Analysts and reports

Frequency: Ad hoc

Location: Shared in various Slack channels

We follow key industry reports that are delivered on a quarterly/yearly cadence. These are often data-rich whitepapers or original research (see examples below). We have partnered with research firms to create this analysis ourselves and will continue to do our own original data collection moving forward. New reports are added to the mix regularly as they are identified from other market trend workstreams.

Sample reports for HR:

Oyster’s Future of HR report in conjunction with 451 Research

Program: News and insights

Frequency: Weekly

Location: Email, Slack, Feedly

We track trending stories through a variety of media and channels. Our primary sources are industry newsletters and blogs, which often curate relevant news from a wide variety of places. We can collect all these sources into Feedly, which highlights notable content and makes it easy to share learnings. This research happens on a weekly basis, and relevant insights are disseminated to the team in Slack or by email.

Sample sources for HR:

Recruiting Brainfood newsletter

Work Tech Weekly newsletter

Program: Qualitative research

Frequency: Quarterly

Location: Various

We have a variety of inputs for qualitative market research, many of which happen at a regular cadence. Several of these inputs are tied to key projects, so the reporting of the learnings and takeaways are often included within those projects (example: pricing). The following is a short list of some of the primary qualitative sources we’ve explored.

Target customer communities. We have partnerships with key communities, which grant us access to speaking with members on a regular basis

Pricing and packaging research. We work with consultants on survey methodology that we take to the market to help understand which jobs, features, and value they expect to receive from a product like ours.

Category research. We speak to three buckets of stakeholders do inform our ongoing category work: “category-aware” HR leaders, “category-unaware” HR leaders, and industry analysts

People team at Oyster. We rely on this team for qualitative feedback about the core behaviors, wants, and needs of distributed HR teams.

Misc.

Lessons from Cash App: Why turning commerce into culture is the best go-to-market strategy

The Wendy’s Effect taking over social media

Wordle 204 5/6

⬜⬜⬜⬜🟩

⬜⬜🟨🟨🟩

🟨🟩🟨⬜🟩

⬜🟩🟩🟩🟩

🟩🟩🟩🟩🟩

Would you rather …

… have the flexibility to WFA but you have to use an iPod Touch as your only device OR be forced to work in an office but you have an unlimited tech budget?

The comments are open! (I don’t know if people want to comment on a newsletter, but I thought I’d give it a try for a few weeks and see what happens.)

About this newsletter …

Hi, I’m Kevan, a marketing exec based in Boise, Idaho, who specializes in startup marketing and brand-building. I currently lead the marketing team at Oyster (we’re hiring!). I previously built brands at Buffer, Vox, and Polly. Each week, I share playbooks, case studies, stories, and links from inside the startup marketing world. Not yet subscribed? No worries. You can check out the archive, or sign up below:

Thank you for being here! 🙇♂️

I’m lucky to count folks from great brands like these (and many more) as part of this newsletter community.