307. How to make competition disappear 🤹

The power of category and audience for turning competition on its head

Hi there 👋

This week’s email is inspired by some super interesting dynamics we’re noticing in our market at Oyster. It’s also inspired by a mid-quarter OKR check-in I just did about our brand recall. Can you believe we’re in the middle of the first quarter already? (The one-eighth mark, if my fourth grade math is correct.)

I swapped the Essay and the Misc. section of the newsletter this week, mostly because I wanted to make sure you all saw the funny comic.

Wishing you a great week,

Kevan

(ᵔᴥᵔ)

Thank you for being part of this newsletter. Each week, I share playbooks, case studies, stories, and links from inside the startup marketing world and my time at Oyster, Buffer, and more.

Say hi anytime at hello@kevanlee.com. I’d love to hear from you.

Misc.

How to use brand positioning to differentiate your brand and win

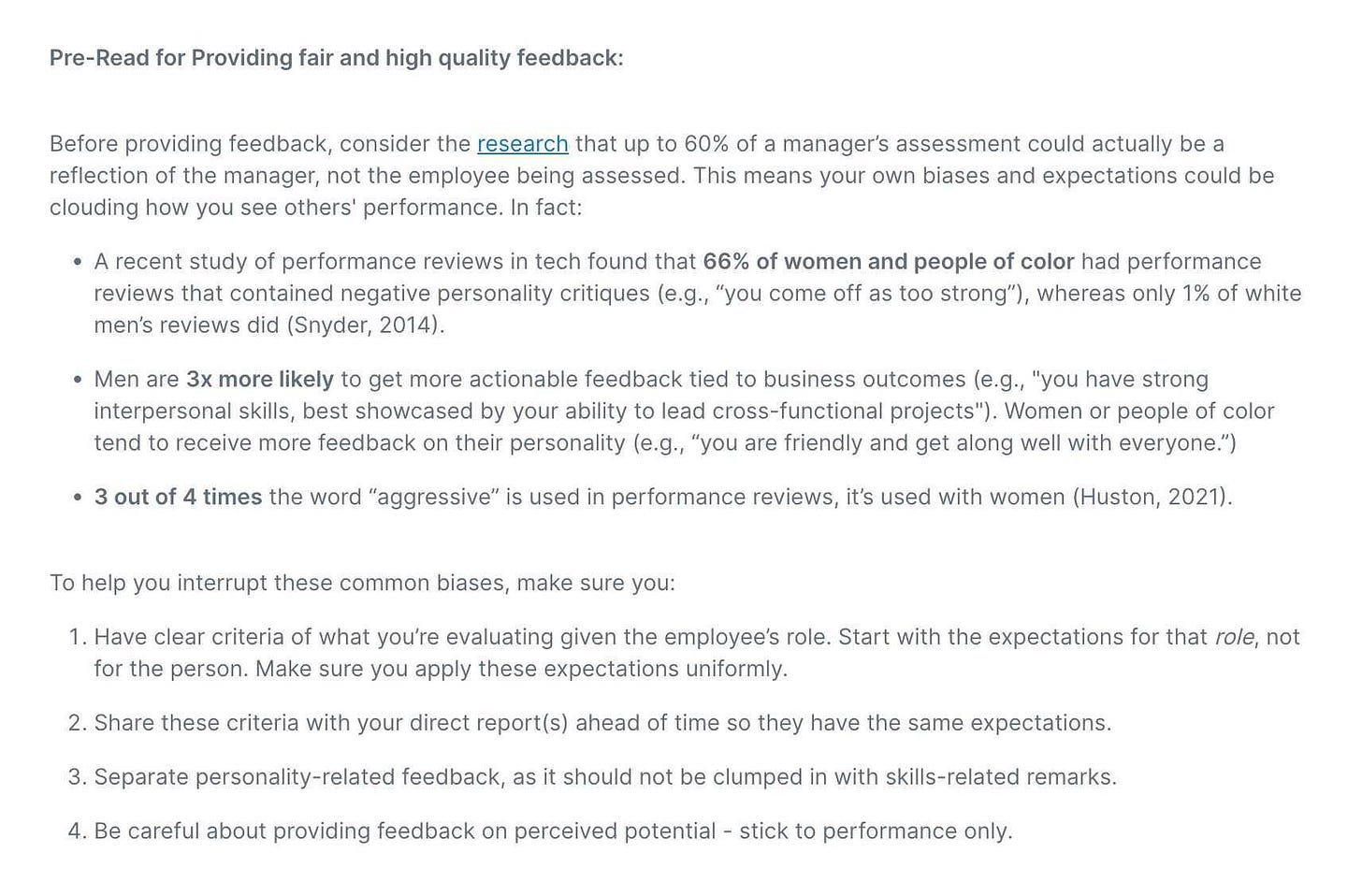

How to provide high-quality feedback in a performance review. From a pre-read that Airtable shares with its people before feedback cycles.

Competition everywhere? Maybe not. When is a competitor not a competitor?

Would you rather work for a company with huge market upside in a highly competitive industry or work for a company on the cutting edge of tech, a true innovator, within a market of early adopters?

Would you rather differentiate or educate?

Would you rather be Webflow today or Webflow five years ago? (or Tesla, or Coinbase, or Miro, etc.)

Most of the time, you have to choose one or the other.

But not always …

When I joined Oyster, I felt like I was diving into one of these two worlds specifically: the highly competitive one. And certainly, it has been competitive. We’re up against a handful of gigantic legacy players and well-funded up-and-comers (of which we are one). We use competitive intelligence tools powered by AI, we have dedicated teammates who specialize in market research, we have Slack channels brimming with detail on what the others in our space are up to.

Differentiation has been a huge focus for us.

But within the battle for differentiation, we’ve found innovation.

Maybe we can have it both ways!

This is where the positioning pillar of your brand strategy becomes so critically important. Words matter, especially the words you use to describe your product.

As a refresher, I think about brand strategy in three pillars: Purpose, Positioning, and Personality. I’ve written about it here. It’s based on Arielle Jackson’s framework here. Within the positioning pillar, you identify a handful of variables to describe what you sell and what makes it unique. Here’s an example for Gmail:

In the third line above, “webmail service” is Gmail’s category name. If you’ve been reading this newsletter long, you’ll know how important I think category is!

Words matter; so do the people you’re talking to.

Competition everywhere? Maybe not.

So when you combine these elements of category and audience, you start to see how a highly competitive landscape begins to look a lot more blue-ocean. This is why having a focused strategy and a core target market matter so much. Let me elaborate with a few examples.

Competition at Oyster

One of the ways we measure our brand at Oyster is through an aided and unaided recall survey. It’s a super simple, two-question survey that goes like this:

Aided: Which of the following [category name] platforms have you heard of? [List you and your competitors, multiple choice]

Unaided: When you think of a [category name] platform, which platform comes to mind first? [Open-ended]

We use Attest for our brand recall surveys, asking this question of various customer segments across a handful of geographies and personas.

Now, when we talk about competitors internally at Oyster, we typically have a handful that are obvious (to us). But when we ask the market what they think, the competitive landscape shifts dramatically.

It’s matters what we ask …

who we ask …

how we talk about ourselves …

and how other products talk about themselves.

For instance, one of the other products in our space is Deel, which offers contractor management, full-time employment services, and financial tools for remote teams. We think of them as a competitor. But does the market? Not necessarily. In our brand recall surveys, Deel comes in well below where we would expect them to land.

A huge part of this is positioning. It matters what question we ask:

Which of the following Distributed HR tools have you heard of?

Which of the following multi-country payroll tools have you heard of?

Which of the following international payments tools have you heard of?

Which of the following Global Hiring platforms have you heard of?

And it matters whom we’re asking. Here’s a look at the segmentation and audience breakdown for one of our brand recall surveys.

There are so many other Employment Sectors we could have asked. Here’s a list (only from A to H because the rest couldn’t fit in my screenshot):

The work we are doing to differentiate the Oyster platform is doing an additional job of making our competitive landscape less competitive.

Competition at Buffer

When you’re shopping for social media management products, you have no shortage of options: there’s Buffer, Hootsuite, Sprout Social (which we use at Oyster), Later, and many, many more. It would appear from an outsider’s view that competition is high.

But to be honest, we didn’t spend too much of our time fretting over competition.

(The only time I remember competition being truly intense was when a new API would open up and all the players in the space would rush to connect. There was a busy month or two when Instagram’s API went live.)

Category wasn’t necessarily the path to freedom like it might be at Oyster. I helped build the social media management category with Buffer, then we spent the next five years carving out our space within the category. Oyster’s category opportunity is still in its infancy (Oyster has only been around for one-plus years).

Instead, Buffer found its competitive freedom from the audience. We chose a small business (B2B) and consumer (B2C2B) segment and matched our go-to-market strategy to that group: affordable pricing, resonant messaging, streamlined product features and UI, and a noteworthy culture.

You could ask the question: When you think of a social media management product, which comes to mind first? And if you were to ask Director-level social media marketers, you’d hear Sprout Social and Hootsuite. If you were to ask small business owners and entrepreneurs, you’d hear Buffer.

What does competition look like for you? Have these category & audience dynamics played out in a similar way?

I’d love your thoughts. Feel free to reply to this email or send me a note at hello@kevanlee.com.

About this newsletter …

Hi, I’m Kevan, a marketing exec based in Boise, Idaho, who specializes in startup marketing and brand-building. I currently lead the marketing team at Oyster (we’re hiring!). I previously built brands at Buffer, Vox, and Polly. Each week, I share playbooks, case studies, stories, and links from inside the startup marketing world. Not yet subscribed? No worries. You can check out the archive, or sign up below:

Thank you for being here! 🙇♂️

I’m lucky to count folks from great brands like these (and many more) as part of this newsletter community.