Hi there 👋

I’ve never done a two-part newsletter before this one, which is not to say this one ends in a high-stakes cliffhanger or anything. I wanted to walk you all through my marketing budget spreadsheet but realized I needed to explain the why first. So this email is the why: Why it’s important to track certain efficiency metrics with how you spend to acquire customers. Next week is the what: a free downloadable copy of the budget spreadsheet I used at Buffer and am implementing at Oyster.

Wishing you a great week ahead,

Kevan

(ᵔᴥᵔ)

Thank you for being part of this newsletter. Each week, I share playbooks, case studies, stories, and links from inside the startup marketing world and my time at Oyster, Buffer, and more.

Say hi anytime at hello@kevanlee.com. I’d love to hear from you.

How to calculate Customer Acquisition Cost (CAC) and CAC Payback

When we talk about metrics that matter for our marketing efforts, we often come back to growth and to brand.

More revenue is better. A more iconic brand is preferred.

(And when it comes to actually measuring brand, phew! — that’s a tough one. Here is one way I’ve done it. We’re also doing brand recall, share of voice, and branded keywords at Oyster.)

But in addition to revenue and brand, it’s important to know how efficient you’re being with the resources at your disposal. This is where Customer Acquisition Cost (CAC) comes in.

CAC is the cost of acquiring a new customer. If you spend an average of $100 to acquire a customer, then your CAC is $100. Seems pretty simple, right? The metric is easy to understand, yes, but when you get into the detail of how to measure it, quickly you notice how complicated things can get. What about the costs of your tech stack? What about the costs of your people? What if a customer came through one channel but had first-touch on another channel?

All these questions are why it’s really important to align with your cross-functional stakeholders — like finance and sales and CS — to agree on definitions for how you’ll calculate.

Generally-speaking, you’ll find there are four ways to define CAC.

1 - Fully-Loaded CAC. This takes into account all of your variable channel spend (e.g. we spent $10,000 on Twitter ads), all of your fixed channel costs (e.g. set-up fees, measurement spend), and all of your marketing overhead (salaries, infrastructure, tools). Fully-Loaded CAC is best used for a high-level budgeting view.

2 - Channel CAC. This takes into account all variable channel spend and all fixed channel costs. It does not include any marketing overhead like salaries or infrastructure. It will give you a fantastic view into the health of your channels.

3 - Marginal CAC. Marginal CAC tells us the cost to acquire the next user on a given channel, so it only takes into account variable channel spend (and ignores the fixed costs of setup, measurement, etc.).

4 - User Segment CAC. This is a close cousin to Marginal CAC with one key difference: Segmented CAC looks at the variable channel spend (just like Marginal CAC) but across unique customer segments. So while Marginal CAC is an average of all customers acquired on a channel, Segmented CAC is one level deeper, with an average of customers within a particular segment.

The most common CAC definitions you’ll find at early-stage startups are Fully-Loaded and Channel CAC.

So, what do you do with these numbers once you have them?

There are a couple different perspectives on CAC that have been relevant in my past (and current) roles. Those are LTV:CAC ratio and CAC Payback.

LTV:CAC ratio compares how much a revenue a customer contributes over their lifetime with your product versus how much it cost to acquire that customer in the first place. A healthy LTV:CAC ratio is 3:1 or greater.

CAC Payback is the time it takes for an acquired customer to have accrued enough revenue to cover the acquisition cost. To take our earlier example of $100 CAC, if a customer pays you $15 per month, it will take seven months for that customer to accrue $100 of revenue. So your CAC Payback is seven months.

Typically if you’re needing to be mindful of cash flow, CAC Payback is your best friend. The sooner you get your money back, the sooner you can go out and spend more of it. LTV:CAC is a useful metric to understand the long-term upside of your spend.

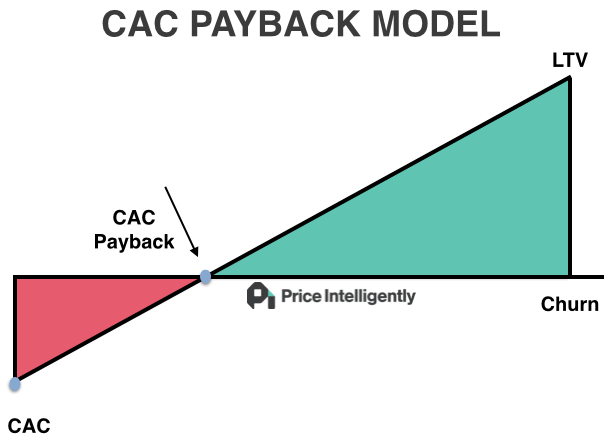

The team at ProfitWell have a neat chart that shows the relationship:

The graph above depicts the early period of the acquisition process (highlighted in red) where your SaaS business is spending time and money. Then as time passes your customer starts to pay monthly for your subscription service and you eventually break even and make your money back on the initial investment. From then on is a magical period (highlighted in green) where you’re rolling in the dough and netting a profit from that customer until they decide to cancel (which is hopefully never).

A real-life example …

At Buffer, we had the fortune of being a profitable business, so our focus on efficiency was related to LTV:CAC rather than CAC Payback.

We went with Fully-Loaded CAC for most of our CAC conversations. It included:

Verrrry little variable channel costs. We didn’t do any paid media (search or social)

Our most significant CAC inputs were salary and tools

Most notably, we included a percentage of our customer experience team as part of CAC because word-of-mouth (driven, to a degree, by our customer experience) was such a big acquisition lever

All in all, because of the sustainable growth loops we built at Buffer across word-of-mouth, content, and brand, we had extremely healthy LTV:CAC of 9:1.

Over to you

How do you measure CAC for your business? What are some of your key inputs? It’d be great to hear how this works for you!

And don’t forget …

Next week, I’ll have a free spreadsheet to share!

Misc.

A-mazing homepage from Amie. Look at that social proof!

From Harry Dry’s marketing newsletter, I thought this copywriting example of metonymy (where a related term stands in for a literal term) was super smart.

If you’re interested in being part of an awesome group of marketing pros, the On Deck team is kicking off its third cohort soon. Come join me (and many, many others).

About this newsletter …

Hi, I’m Kevan, a marketing exec based in Boise, Idaho, who specializes in startup marketing and brand-building. I currently lead the marketing team at Oyster (we’re hiring!). I previously built brands at Buffer, Vox, and Polly. Each week, I share playbooks, case studies, stories, and links from inside the startup marketing world. Not yet subscribed? No worries. You can check out the archive, or sign up below:

Thank you for being here! 🙇♂️

I’m lucky to count folks from great brands like these (and many more) as part of this newsletter community.